Art Streiber

Sir Fraser Morrison (left) and Peter Morrison

Peter Morrison is nervous. He has just taken the podium in the Piper Auditorium, at Harvard’s GSD, before a crowd of architecture-firm CEOs—his peers. Wearing a navy suit and a blue-and-white checked shirt with cuff links, the 34-year-old CEO of the U.K.-based megafirm RMJM, a rugby enthusiast and former officer in the British army, would look more at home in London’s banking district, talking global finance over a few pints in the pub. Instead, he’s here at the GSD, announcing his firm’s $1.5 million gift to the school for a new program in “integrated design.” It is an unmistakable bid by RMJM for the attention of the American design elite.

Morrison delivers his speech, which he has memorized. After some polite praise of the school and its professors, he visibly relaxes as he warms to his theme: the architect of the future. “I believe the architect of the future will be much more than a stylist,” he says. “Instead, he or she will be a leader … The architect of the future must regain the status of master builder.” He lauds RMJM’s collective process as superior to “the media-created phenomenon” of the “starchitect” before moving on to some “hard truths” of the industry as a whole: first and foremost, that the financial reward for architects is “miniscule,” so that the agent who sells a building will often earn a higher fee than the firm that designed it (a fact that Morrison will point out to me multiple times over two days in Cambridge). He wonders why a top-tier design firm can’t command the same respect and compensation for its “intellectual capital” as McKinsey, the famed management consulting company, does.

This call to arms, albeit a rather mild one, seems to go over well with the audience. But one listener doesn’t need any convincing. Sitting inconspicuously in the middle of the room, beside his wife, is Sir Fraser Morrison, Peter’s father —and the CEO of RMJM Hillier, the American arm that RMJM gained last year when it acquired Hillier Architecture for $30 million. The story of how two non-architects came to run one of the world’s biggest architecture firms— and now aspire to turn it into one of the world’s most valued design brands—starts with him.

“I RECKONED I KNEW HOW TO SORT IT” Fraser Morrison was born in Tain, a small town in the Scottish Highlands, in 1948, the same year his father established Morrison Construction. His father “built houses, he built factories, he built whatever there was to build,” says Sir Fraser, whose soft burr and polite, almost diffident manner are at odds with the larger-than-life persona of many a business leader.

For its first two-and-a-half decades, the business remained small and local, its reach confined to the sparsely populated north of Scotland. But that changed in 1974, when it was bought by a mining conglomerate. A few years later, Fraser Morrison—who had joined Morrison Construction in 1970, after finishing a degree in civil engineering, and stayed on to run it under the new owners—moved the base of operations to Edinburgh, Scotland’s capital. Thanks in part to the economic boost from the recent discovery of North Sea oil, Morrison’s division expanded from a building contractor to “a very broadly spread construction business,” involved in building homes, roads, and bridges, and in commercial development.

Despite his success running it, Morrison could see that the division “wasn’t flavor of the month,” as he puts it, inside the conglomerate. The owners weren’t especially interested in its fortunes and didn’t know how to manage the high risks inherent in construction. “The [construction] business in England had been losing a lot of money,” he says. And then, an understatement that could be attributed to Scottish pragmatism or personal modesty, or a mix of both: “I reckoned I knew what needed to be done to sort it.”

Sort it he did. In 1989, Fraser and Gordon Morrison, Fraser’s brother, led a management buyout of the Scottish construction division as well as the underperforming English one. Over the next decade, the brothers grew the business into one of the largest construction firms in the U.K. Fraser Morrison was knighted in 1998. In 2000, the Sunday Times of London named him the second-richest person in Scotland —right behind J.K. Rowling of Harry Potter fame—with 1999 earnings of more than £23 million. The same year, the Morrison brothers sold their company to a British utility, AWG, for £263 million.

In 2003, with Morrison foundering under new ownership, AWG slapped Sir Fraser with a £130 million lawsuit, alleging that he had exaggerated his company’s profit forecast. Sir Fraser called the claim “preposterous,” blaming the decline on AWG’s poor oversight. The lawsuit dragged on until 2006, when it was settled out of court, with Sir Fraser reportedly paying AWG £10 million.

STAGNATION AND BUYOUT One of the biggest projects that Morrison Construction took on before the sale to AWG was the Falkirk Wheel, a massive rotating boat lift that connects two Scottish canals, one of which lies 115 feet below the other. Originally, Morrison “bid on that project on a design-and-construct basis,” Sir Fraser recalls. “And the client came to us and said, ‘We really want to do this with you, but we think your design’s awful. Can you do something about it?’ ”

Morrison couldn’t, but RMJM, a Scottish architecture firm founded in 1956, could. The firms had worked together on numerous projects over the years. With a consortium including Morrison handling the engineering side, RMJM designer Tony Kettle came up with a striking, playful scheme that resembles a row of giant bottle-openers. Finished in 2002, the Wheel is now one of Scotland’s top tourist attractions and even appears on Scottish banknotes.

One month before Queen Elizabeth II officially opened the Wheel as part of her Golden Jubilee, another event that was more momentous for RMJM occurred—this time without any fanfare. Sir Fraser backed a management buyout of RMJM. The firm had “stagnated,” he says. Sixty percent of the shares were held by people who didn’t have an active interest in the company: retired partners, the families of partners who had died. The working shareholders approached Sir Fraser and asked him to help.

“ ‘We have this problem’: That’s how they put it,” he recalls, summing up the rest of their pitch: “ ‘We know you know us, we know you know the industry—are you interested in sitting down with us and trying to figure out a way forward?’ ” In the words of Bob Hillier, the founding principal of Hillier Architecture and now a “lifetime principal” of RMJM Hillier, “Fraser kind of backed into [architecture]. And then he got fascinated by it.”

After an exploration period of nine months, beginning in late 2001, Sir Fraser bought out the nonworking shareholders and invested money in the company. The working directors also bought more shares, “so we had buy-in, a successful formula for making a management buyout work.” With a 56-percent stake in RMJM, Sir Fraser and son Peter, then 28 and having just earned an MBA from Imperial College, London, joined the firm as non-executive directors. Peter took over as CEO in 2005 and, two years later, appointed his father to run RMJM Hillier. (The upside-down arrangement gives rise to some gentle joking between father and son: Asked whether he plans to stay in New York long-term, Sir Fraser deadpans, looking sidelong at Peter, “Depends what the boss says.”)

To describe RMJM at that time as stagnated would, however, be charitable. Thirty miles from the Falkirk showpiece, in Edinburgh, the firm was grappling with a project that kept sprouting new heads, arms, legs—the new home for the Scottish Parliament, designed by Catalan architect Enric Miralles with RMJM acting as executive architect. Miralles had died shortly after completing the design, leaving the project without its visionary. By the time the building was finally finished in 2004, costs had reached a staggering £414 million—10 times the original estimate—and the Scottish government had conducted an inquiry into the delays and overruns.

According to British press reports, Brian Stewart, then chief executive of RMJM, broke down in tears while giving evidence. He left the firm in 2005, amid rumors that he had been forced out. The head of the inquiry, Lord Fraser of Carmyllie (no relation to Sir Fraser Morrison), concluded that most of the blame lay with the client for choosing a “fast track” procurement method while not understanding the risks and complexities involved. Still, in his final report, Lord Fraser observed that RMJM and EMBT, Miralles’ firm, “had very different cultures and ways of working and found it difficult to adopt a cohesive approach … whilst working in separate locations and communicating mainly via fax.”

In the midst of the recriminations over the parliament—which won the Stirling Prize, Britain’s most illustrious architecture award, in 2005—did the Morrisons regret their decision? Never, they claim. “Outside of Scotland, very few people related to the controversy over it,” says Peter Morrison. “It was largely recognized as a fantastic design, an iconic building.” Sir Fraser says that it’s been a “springboard” for designing major projects around the world, and his son agrees: “We had the guys from Gazprom there for a day, and we could barely get them out of it. They ended up there for five or six hours, going around looking at the detailing.”

On that day, an old controversy met one that was just brewing.

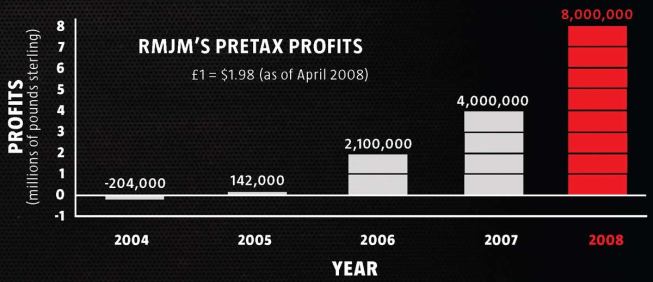

AFTER THE MERGER, LITTLE FALLOUT Profits at RMJM have jumped exponentially since the Morrisons arrived—nearly 90 percent between 2006 and 2007 alone—and when they recount how they turned things around, you marvel not so much at their business acumen as at the state of the company they inherited. Back in 2003, when it was a firm of 350 people in four countries, RMJM did not have an attorney on staff, or an accountant.

“They had the architects doing everything,” recalls Peter Morrison. “They were managing the finance systems, they were managing the HR, the marketing; for all we know, they were taking the board minutes.” Morrison remembers asking a now-departed executive, in 2003 or 2004, where the conference phones were kept. “I was told there was one conference phone in the entire firm, and it was locked away in [a] cupboard.”

The solution was simple: Get the designers back to designing by improving support systems, and make sure they’re talking to each other. Peter Morrison put a finance management system in place and beefed up the firm’s marketing and business development efforts. A corporate law firm was retained to help negotiate contracts. Architects in Hong Kong and Dubai were encouraged to talk to—and work with— their colleagues in Glasgow and London.