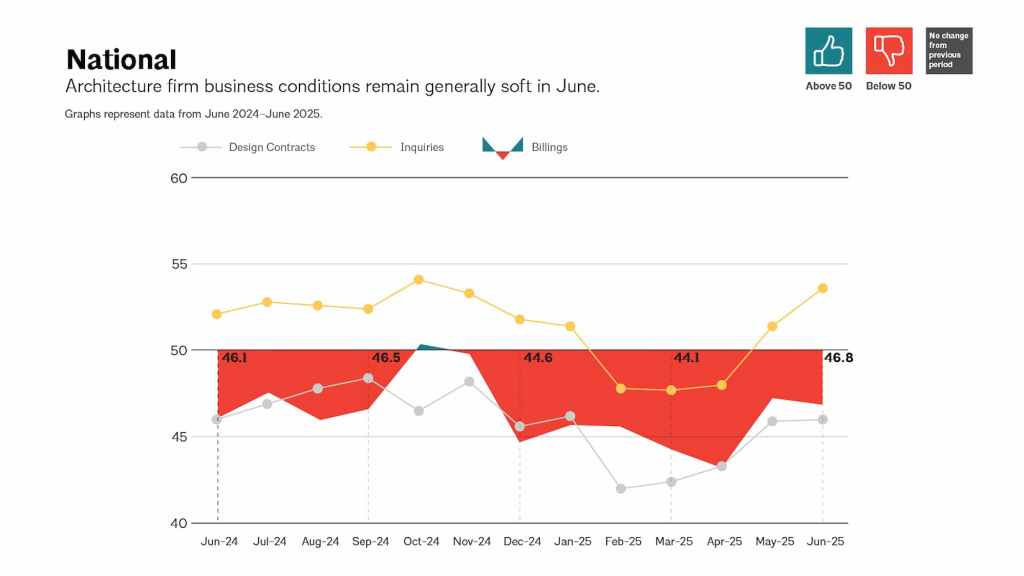

Billing activity at U.S. architecture firms continued to dip in June, according to the latest AIA/Deltek Architecture Billings Index (ABI). The index posted a score of 46.8—down slightly from May’s 47.2—marking yet another month in negative territory as more firms reported reduced revenue.

Despite the bleak headline number, there are emerging signs of client re-engagement. The project inquiries index climbed to 53.6—the highest since last fall—suggesting that more clients are actively seeking architectural services. However, this optimism is tempered by the continued decline in newly signed design contracts, which dropped for the 16th straight month.

“It is unlikely that firm billings will return to positive territory until the value of new design contracts also starts to increase again,” the report cautions.

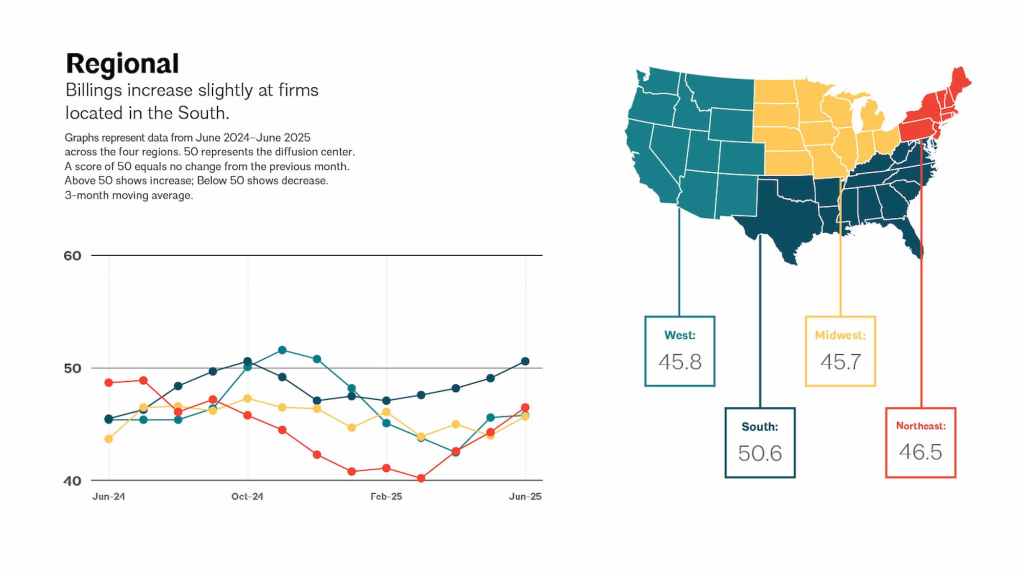

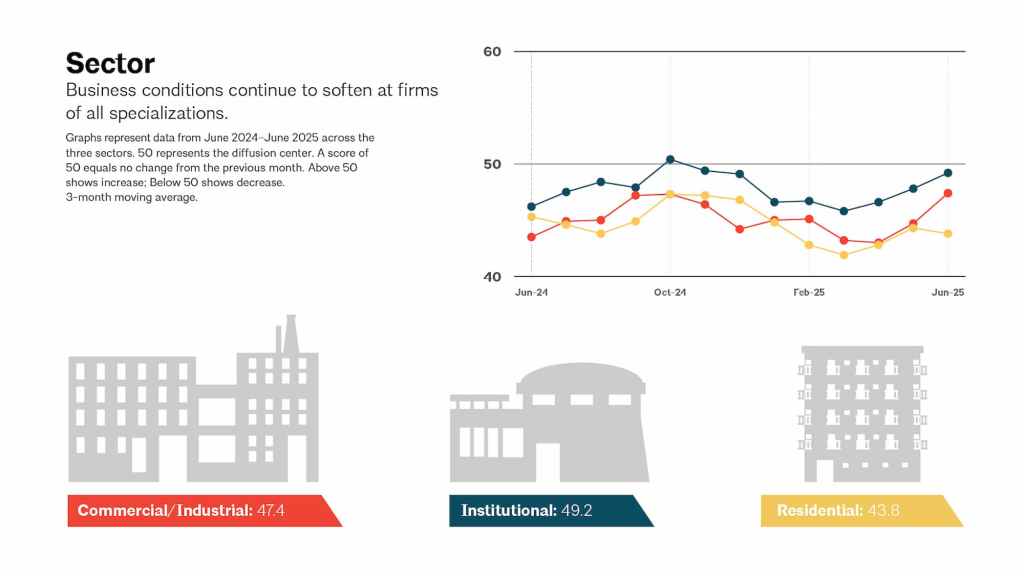

“Business conditions were soft nationwide in June, with a slight billing increase in the South for the first time since October,” said Kermit Baker, PhD, AIA Chief Economist. “Other regions saw declining billings, though at a slower pace. While all specializations experienced softer billings, the decline slowed for commercial/industrial and institutional firms. Multifamily firms faced the weakest conditions, with further declines.”

Regional and Sector Breakdown

The South was the only region to see growth in billings, hitting 50.6. Meanwhile, the Midwest (45.7), West (45.8), and Northeast (46.5) all remained in contraction territory. Among sectors, institutional work performed the strongest (49.2), followed by commercial/industrial (47.4), mixed practice (45.5), and multifamily residential, which dropped to a weak 43.8.

Still, the lack of movement in signed contracts continues to weigh heavily on short-term prospects. For the architecture profession, it’s a waiting game between signs of interest and actual investment.

The AIA and Deltek encourage firms to leverage available resources to weather the economic uncertainty and prepare for potential reactivation of stalled or delayed projects.