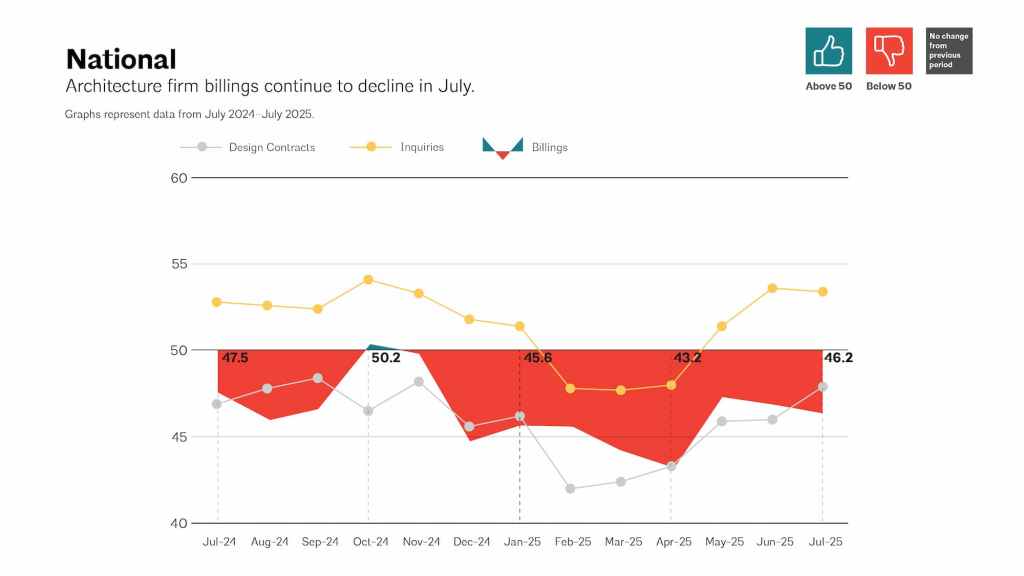

The latest AIA/Deltek Architecture Billings Index (ABI) paints a sobering picture for the profession: billings continue to slide, extending a downturn that has now stretched across nearly three years.

The index registered a score of 46.2 in July, down from 46.8 in June. Any score below 50 indicates declining firm billings, underscoring how widespread the slowdown remains.

“Business conditions remain challenging for architecture firms nationwide, with billings declining across all regions in July,” said Kermit Baker, PhD, AIA Chief Economist. “Client inquiries into new projects continue to build. Still, while commercial and institutional sectors show some signs of stability, the multifamily residential sector still is facing significant headwinds.”

The numbers reveal both resilience and risk. On one hand, inquiries into new work climbed steadily in July, continuing an upward trend following a three-month pause earlier this year. On the other hand, design contract values fell again—evidence that the growing interest isn’t translating into actual commissions. This conversion gap has persisted for more than two and a half years, leaving firms squeezed between hopeful signals and harsh realities.

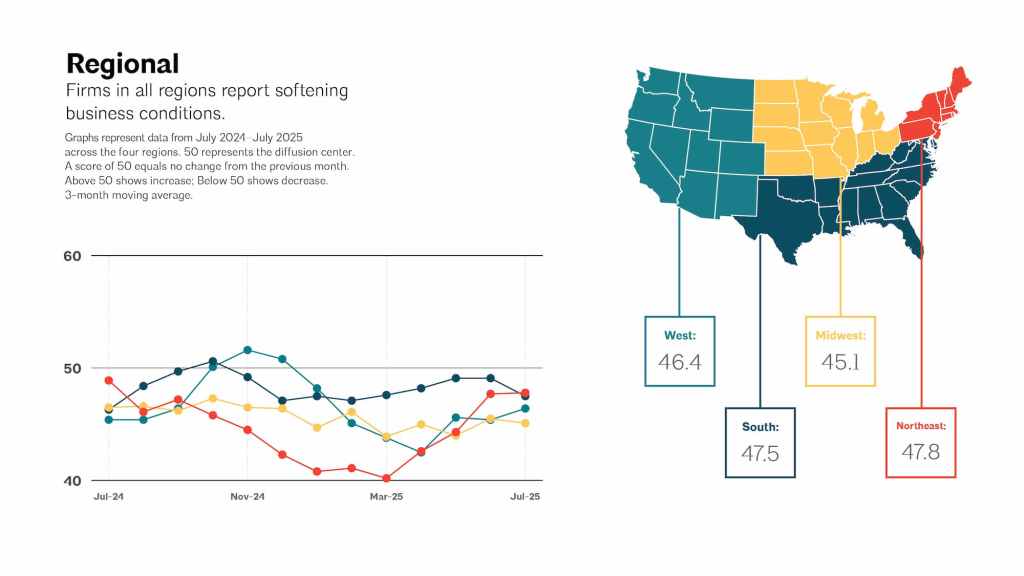

Regional and Sector Breakdown

The downturn is broad-based, touching every part of the country: Northeast (47.8), South (47.5), West (46.4), and Midwest (45.1).

Among building sectors, commercial/industrial work (49.9) is the closest to stabilizing, while institutional projects (47.9) are still sluggish. Mixed-practice firms (42.8) and multifamily residential (43.7) continue to bear the brunt of the slowdown.

Meanwhile, the project inquiries index rose to 53.4, signaling growing client interest, but the design contracts index slipped to 47.9, confirming firms’ difficulty in securing tangible commitments.

A Lingering Malaise

The persistence of negative billings—31 of the past 34 months—raises questions about the depth of architecture’s ongoing malaise. While the commercial and institutional sectors may be inching toward equilibrium, the weak multifamily market underscores broader economic pressures shaping demand for design services.

For firms across the country, the challenge is clear: inquiries alone won’t sustain practice. Until those signals translate into contracts, architecture’s recovery remains out of reach.