This story was originally published in Builder.

Freddie Mac’s (OTCQB: FMCC) Primary Mortgage Market Survey, out Thursday, reported that the 30-year fixed-rate mortgage has fallen to a 10-month low.

Said Sam Khater, Freddie Mac’s chief economist, “The U.S. economy remains on solid ground, inflation is contained and the threat of higher short-term rates is fading from view, which has allowed mortgage rates to drift down to their lowest level in 10 months. This is great news for consumers who will be looking for homes during the upcoming spring homebuying season. Mortgage rates are essentially similar to a year ago, but today’s buyers have a larger selection of homes and more consumer bargaining power than they did the last few years.”

News Facts

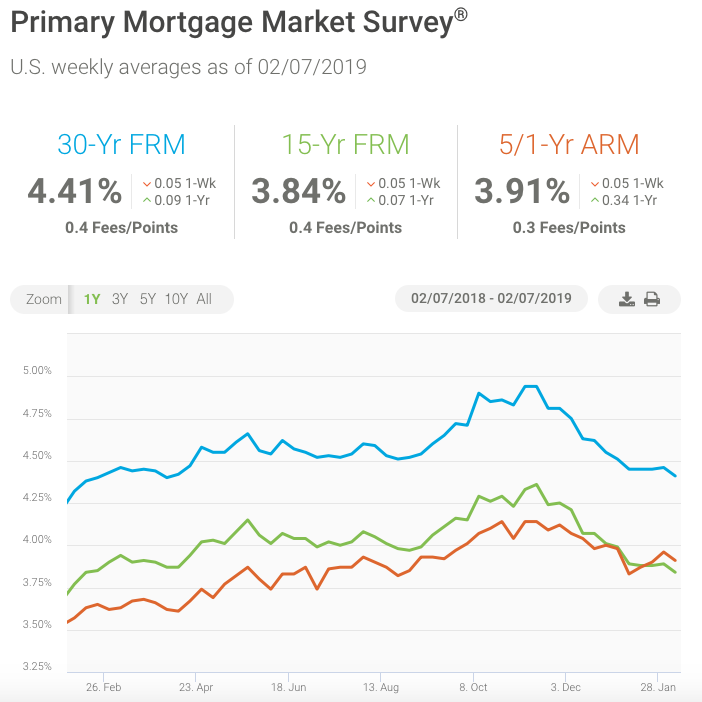

· 30-year fixed-rate mortgage (FRM) averaged 4.41% with an average 0.4 point for the week ending February 7, 2019, down from last week when it averaged 4.46%. A year ago at this time, the 30-year FRM averaged 4.32%.

· 15-year FRM this week averaged 3.84% with an average 0.4 point, down from last week when it averaged 3.89%. A year ago at this time, the 15-year FRM averaged 3.77%.

· 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.91% with an average 0.3 point, down from last week when it averaged 3.96%. A year ago at this time, the 5-year ARM averaged 3.57%.

This story was originally published in Builder.