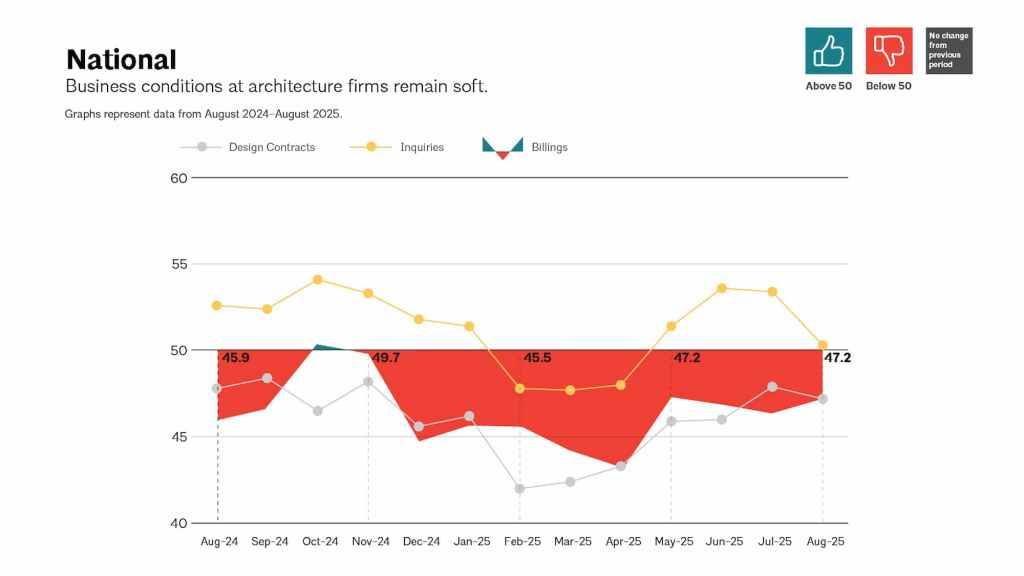

Architecture firms continued to face soft business conditions in August, with the AIA/Deltek Architecture Billings Index (ABI) registering a score of 47.2. While the share of firms reporting declining billings edged down slightly from July, the overall trend remains negative.

The latest figures mark a sobering milestone: the value of new design contracts fell for the 18th consecutive month, the longest decline in the 15-year history of the ABI. Throughout 2024, the industry has been characterized by weak inquiries and a steady contraction in newly signed projects, as clients remain reluctant to commit to large-scale work. With limited new projects in the pipeline, many firms are bracing for continued drops in billings in the coming months.

“While business conditions remained soft at architecture firms nationally, there are signs that the downturn may be bottoming out,” said Kermit Baker, PhD, AIA Chief Economist. “Inquiries for new projects have increased four straight months, and billings both at firms with a multifamily or commercial/industrial specialization are beginning to stabilize.”

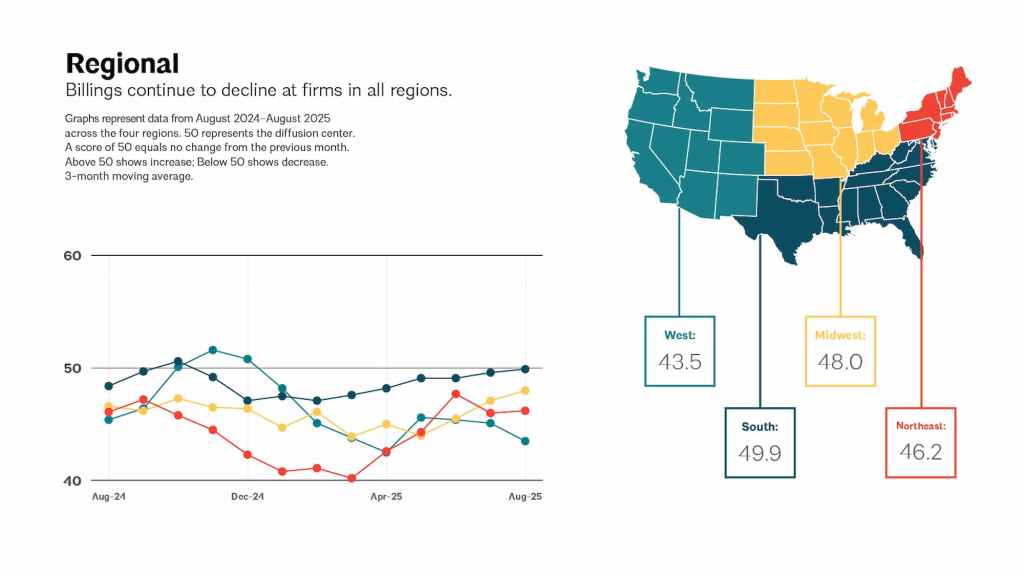

Regional and Sector Trends

The softness was felt across all U.S. regions in August, though some markets fared better than others. Firms in the South reported the highest index score at 49.9, followed by the Midwest (48.0), the Northeast (46.2), and the West (43.5), which continues to lag behind the rest of the country.

By specialization, commercial/industrial practices led the pack with an index of 50.8, suggesting a return to growth in that sector. Multifamily residential firms trailed slightly at 49.9, while institutional practices (44.5) and mixed-practice firms (43.3) struggled with deeper declines.

The project inquiries index provided a faint sign of optimism, ticking up to 50.3 in August, even as the design contracts index landed at 47.2, underscoring ongoing client hesitation.

Outlook

The AIA’s latest report highlights the uneasy reality confronting architects: while select sectors show signs of stabilizing, the industry overall remains in its most protracted slump since the Great Recession. With 18 months of contracting design contracts, firms face a challenging fall season, and the timeline for recovery remains uncertain.