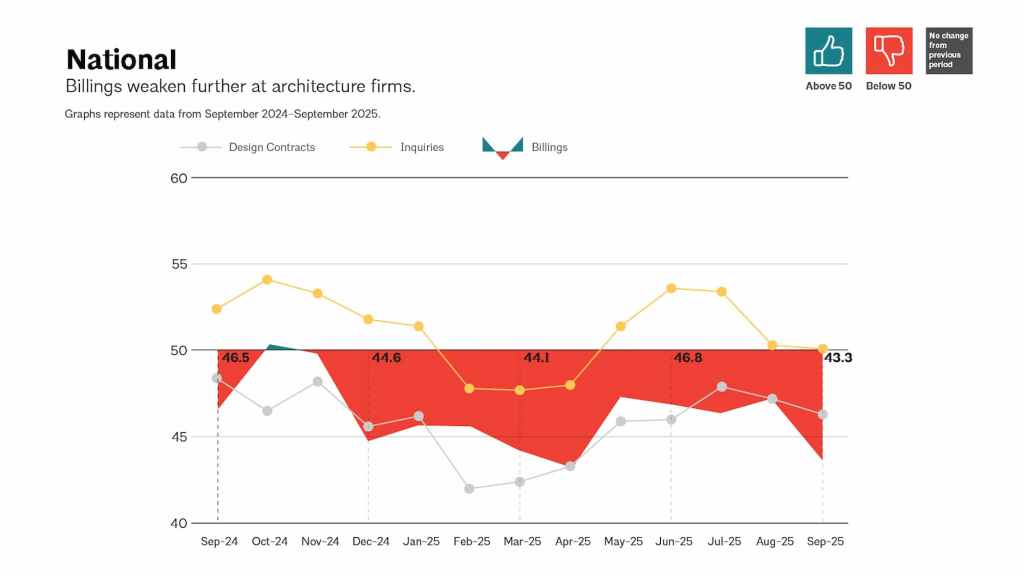

After months of optimism that the slowdown in design work might finally stabilize, September’s AIA/Deltek Architecture Billings Index (ABI) delivered a sobering message: the industry’s headwinds are far from over.

The ABI fell to 43.3, the lowest level since April, signaling a continued contraction in billings across most U.S. regions and sectors. The only exception was the Midwest, where activity remained flat. Firms in the West, however, saw the steepest drop for the fourth consecutive month—a troubling sign for one of the country’s historically strongest design markets.

“Unfortunately, business conditions remain relatively weak at architecture firms,” said Kermit Baker, Ph.D., AIA Chief Economist. “There was some erosion in project backlogs this past quarter, with the greatest slippage coming from firms with an institutional specialization.”

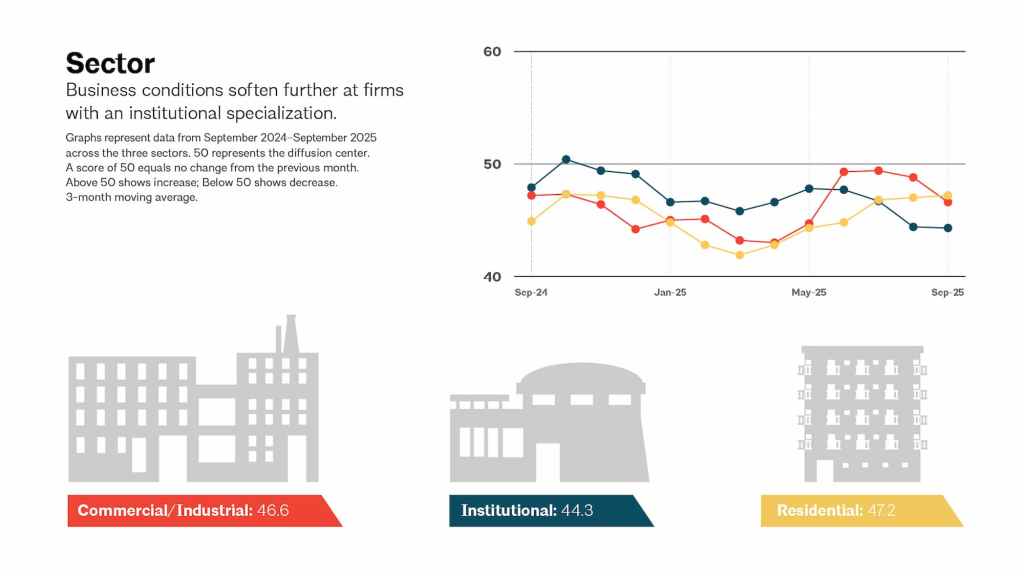

That weakness tracks closely with the latest sector data:

- Institutional firms posted the lowest score at 44.3,

- Commercial/industrial firms softened to 46.6 after a brief summer rebound,

- Multifamily residential firms remained below the growth threshold at 47.2, and

- Mixed-practice firms recorded 44.0.

Meanwhile, project inquiries hovered at 50.1, barely indicating growth, while design contract values fell for the 19th consecutive month, underscoring ongoing client hesitancy amid economic uncertainty.

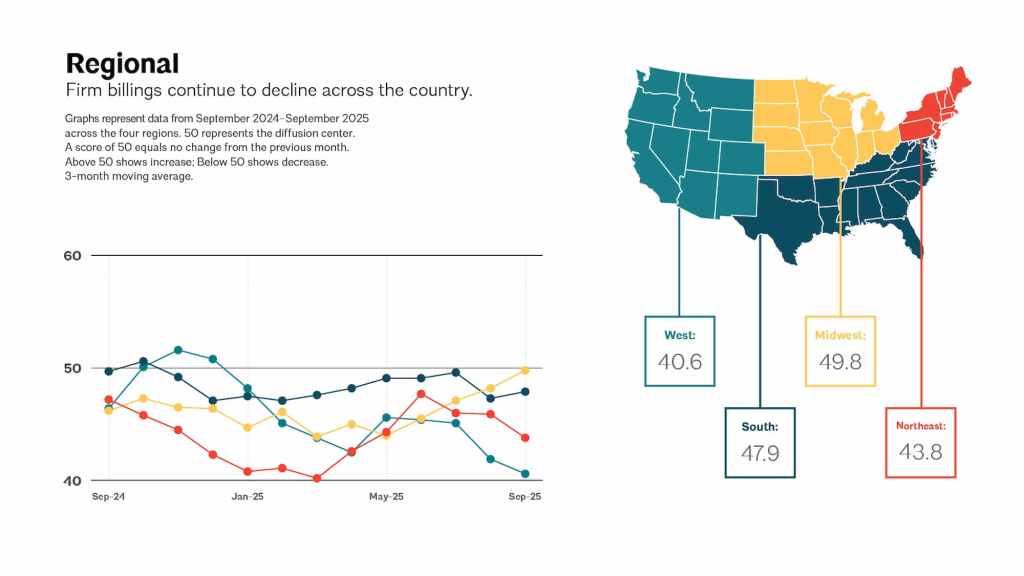

Regional Breakdown

- Midwest: 49.8 (flat)

- South: 47.9 (declining)

- Northeast: 43.8 (sharp decline)

- West: 40.6 (steepest drop)

The AIA notes that these figures are calculated as three-month moving averages and may not directly align with the national composite score, but the pattern is unmistakable: momentum continues to ebb across nearly every major market.

A Fragile Recovery?

The current slump reflects a broader unease across the built environment. High interest rates, cost inflation, and delayed public-sector funding have weighed heavily on design pipelines. For many firms, especially smaller practices or those tied to institutional work, the question has shifted from when the rebound will arrive to how to endure until it does.

Even as architects grapple with these realities, Baker notes that some firms are positioning strategically for eventual recovery—refocusing on efficiency, diversification, and long-term planning.

Resources for Firms

To support practices navigating the downturn, AIA continues to offer business resources and policy advocacy aimed at promoting stability in the profession. Meanwhile, Deltek, which provides enterprise management software for more than 12,000 A&E firms worldwide, emphasizes that real-time project data and financial insight can be critical tools for resilience during economic uncertainty.

With billings contracting for most of 2025, architecture firms face an uncomfortable reality: recovery will likely be uneven, slow, and dependent on regional and sectoral shifts that remain difficult to predict. For now, the numbers tell a clear story—caution has replaced confidence, and architecture’s long slowdown isn’t over yet.