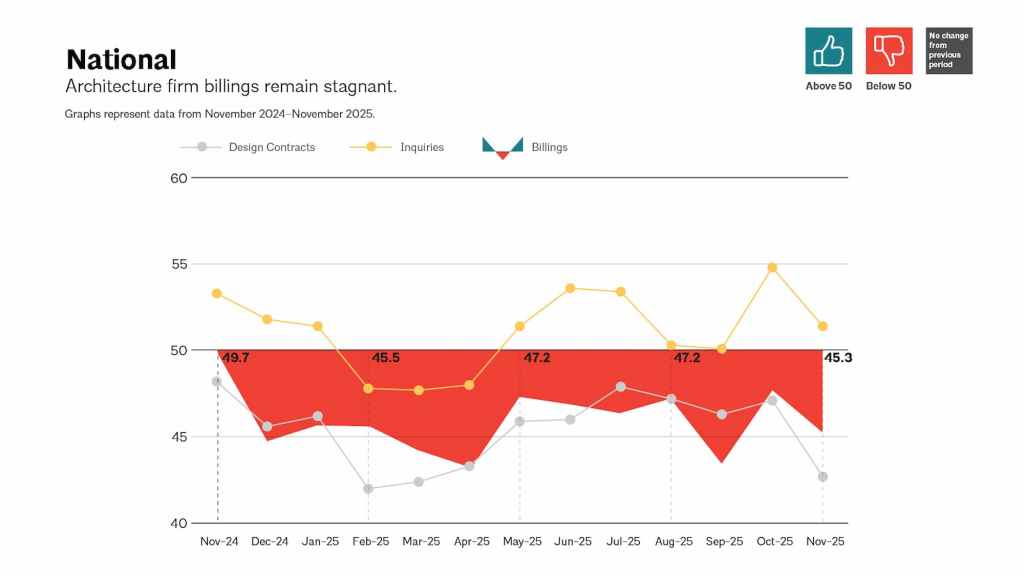

Business conditions at U.S. architecture firms remain locked in a prolonged slump, according to the latest data from the American Institute of Architects. The AIA/Deltek Architecture Billings Index (ABI) for November registered at 45.3, extending the industry’s downturn to a 13th consecutive month of declining billings—and marking the 35th time in the last 38 months that the index has fallen below the growth threshold of 50.

The persistent weakness underscores the depth and duration of the current slowdown. While architecture firms continue to report modest gains in inquiries for new projects, those early signals have yet to translate into stronger revenues. The value of newly signed design contracts continued to soften in November, suggesting that many firms will remain under pressure until stalled projects in the pipeline begin to move forward again.

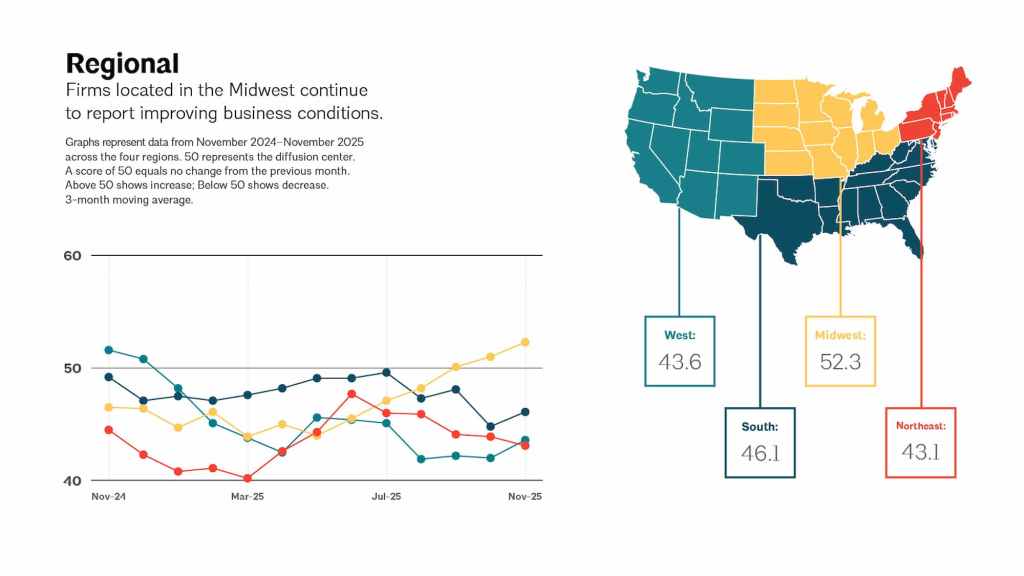

“Weakness in business conditions at architecture firms continues to be widespread, with declining billings across all major specializations and in every region except the Midwest,” said Kermit Baker, PhD, AIA Chief Economist. “However, inquiries for new projects continued to increase, and design activity at firms in the Midwest – a region that traditionally has had a disproportionate share of manufacturing activity – appears to have hit its bottom for this cycle and is expected to continue to improve.”

Regionally, the Midwest stood out as the sole area posting growth, with an average ABI score of 52.3. All other regions remained in contraction territory, including the South at 46.1, the West at 43.6, and the Northeast at 43.1. The uneven geography reflects broader economic crosscurrents, with manufacturing-heavy markets showing more resilience than regions more dependent on commercial real estate and institutional development.

Across practice types, no sector escaped the slowdown. Institutional firms posted the strongest performance, though still below expansion levels, with an index score of 47.6. Multifamily residential firms followed at 46.6, while commercial and industrial practices registered 45.2. Mixed-practice firms—those without a dominant specialization—reported the weakest conditions, with a score of 44.5.

Leading indicators offer a mixed picture. The project inquiries index rose to 51.4, signaling continued client interest and early-stage planning activity. At the same time, the design contracts index fell to 42.7, reinforcing concerns that economic uncertainty, financing constraints, and cautious developers are delaying commitments.

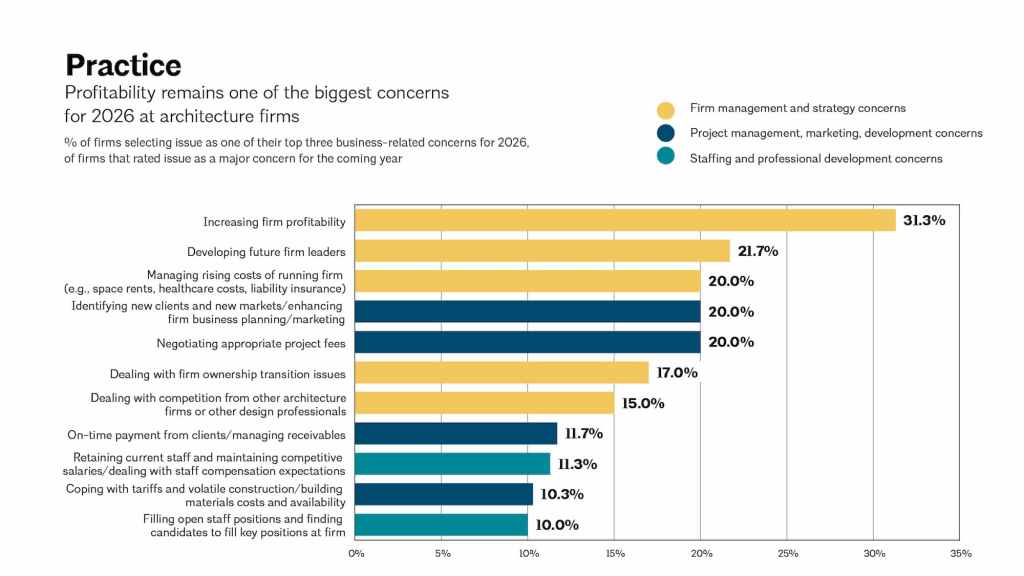

As the profession navigates this extended period of softness, many firms are focusing on cost controls, diversification, and strategic positioning for an eventual rebound. For now, however, the November ABI makes clear that a broad-based recovery remains elusive—and that architecture firms may need to brace for continued volatility before sustained growth returns.

The regional and sector categories are calculated as three-month moving averages and may not always average out to the national score.