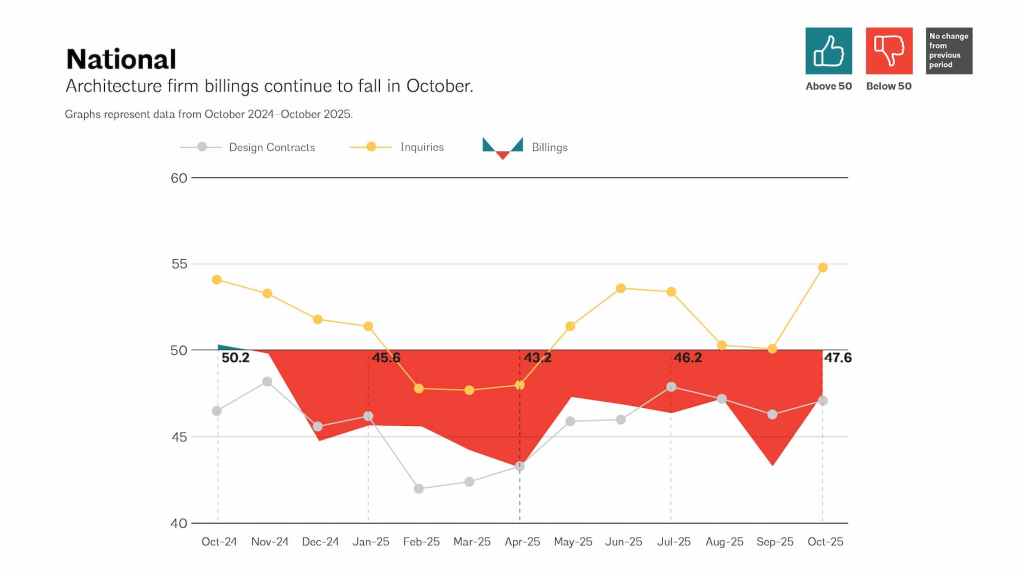

U.S. architecture firms closed out October with another month of contracting billings—despite a modest improvement in the American Institute of Architects’ latest Architecture Billings Index (ABI). The reading, released this week, underscores the unevenness that has defined the profession’s economic outlook throughout 2025.

The ABI score rose to 47.6 in October, up from 43.3 in September. While still below the threshold of 50 that signals growth, the shift indicates that fewer firms experienced declining revenue last month. Firms also reported their strongest increase in project inquiries in 18 months, hinting at improved client interest.

Yet that optimism was tempered by another drop in the value of new design contracts, a key leading indicator for future work. Many firms continue to face protracted financing challenges, lengthening approval timelines, and client uncertainty across multiple building types.

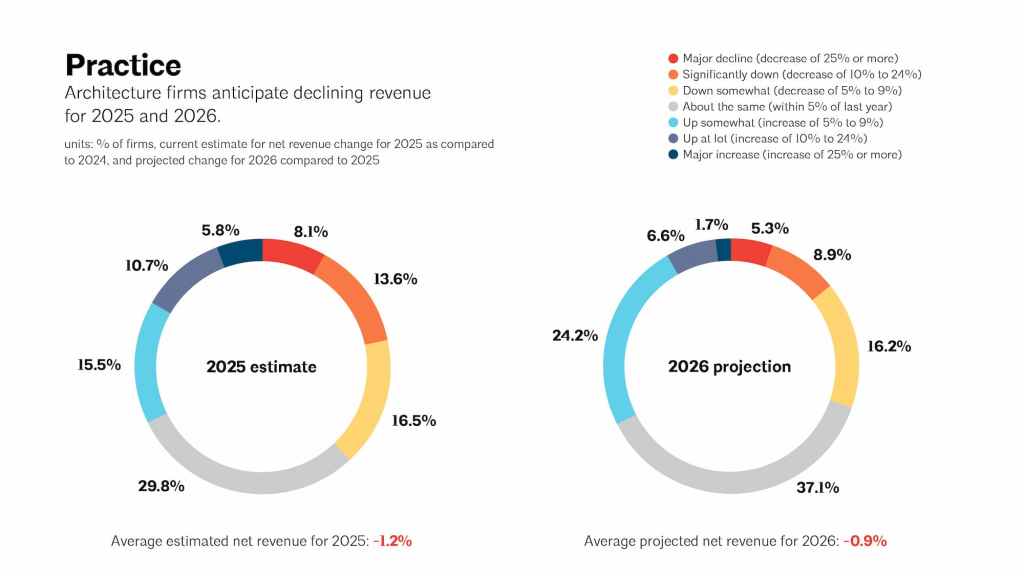

“Architecture firms estimate that billings declined modestly this year. Unfortunately, they are not expecting a significant turnaround in 2026,” said Kermit Baker, PhD, AIA Chief Economist. “About a third of firms nationally project that their billings will increase this coming year, and a slightly higher share expect them to remain about the same. Firms with a multifamily specialization are the most optimistic about prospects for 2026.”

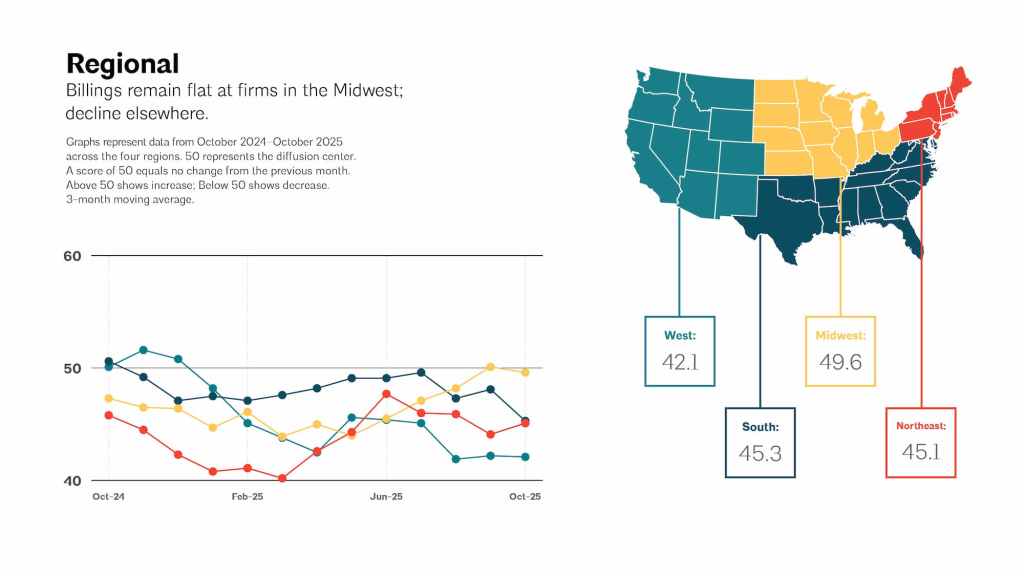

Regional Patterns Reveal Ongoing Disparities

Regionally, conditions remain starkly uneven:

- Midwest: 49.6

- South: 45.3

- Northeast: 45.1

- West: 42.1

The Midwest is nearing stabilization, while firms in the West continue to face the steepest declines—mirroring broader slowdowns in commercial and institutional development in that region.

Sector Performance: Multifamily Leads Cautious Optimism

Across building sectors, the picture is similarly mixed:

- Multifamily residential: 46.8

- Commercial/industrial: 43.9

- Institutional: 46.1

- Mixed practice: 44.0

Multifamily work remains the strongest performer, capturing the sector’s highest level of optimism heading into 2026 as demand continues in key markets. By contrast, commercial and mixed-practice firms are experiencing the most volatility, reflecting shifts in workplace, retail, and industrial investment patterns.

Leading Indicators Offer Conflicting Signals

Two additional data points reflect the push-and-pull currently shaping planning decisions in firms across the country:

- Project inquiries: 54.8

- Design contracts: 47.1

While the surge in inquiries suggests an uptick in early-stage conversations, the softening of design contracts points to ongoing hesitancy among project owners to formally initiate work.

A Profession Watching the Horizon

As firms finalize projections and staffing for 2026, the profession finds itself looking for signs of stability in an economic climate defined by uncertainty. While October’s ABI marks an improvement over September’s sharp contraction, the broader outlook remains cautious.

With inquiries rising, multifamily work holding firm, and regional disparities deepening, the coming months may prove decisive in determining whether the industry can turn a slow late-year lift into a more decisive recovery.