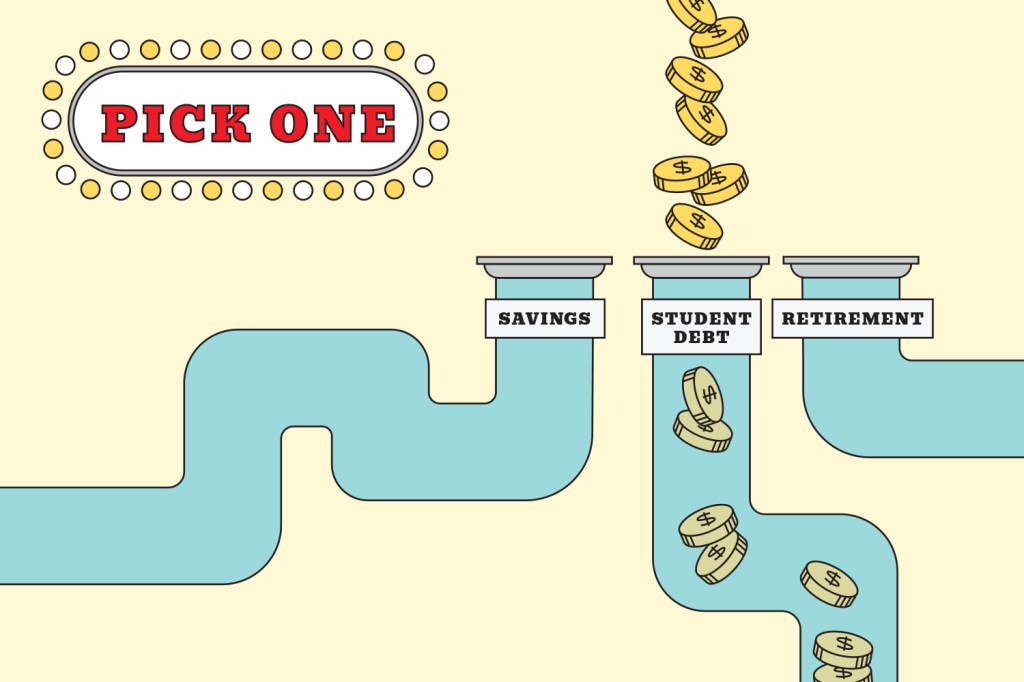

Eighty-six percent of AIA members who have not yet paid off their student loan debt said that it was difficult for them to save for retirement due to their monthly payments. Additionally, 83% of that subset reported that it was difficult to buy a house, and 65% reported that it was challenging to start a family. First-generation students are significantly more likely to struggle with retirement savings and investing than those whose parents went to college. This data was collected as part of a larger effort by AIA to understand the impact of student loan debt on the profession of architecture.

Source: AIA Student Debt Survey, 2022, conducted in partnership with Ipsos